Continuing uncertainty pushed total commercial real estate transaction dollar amounts in seven major asset classes and Canadian regions down to $50.6 billion last year — down from $56.4 billion in 2024 and $54.8 billion in 2023 — according to Altus Group.

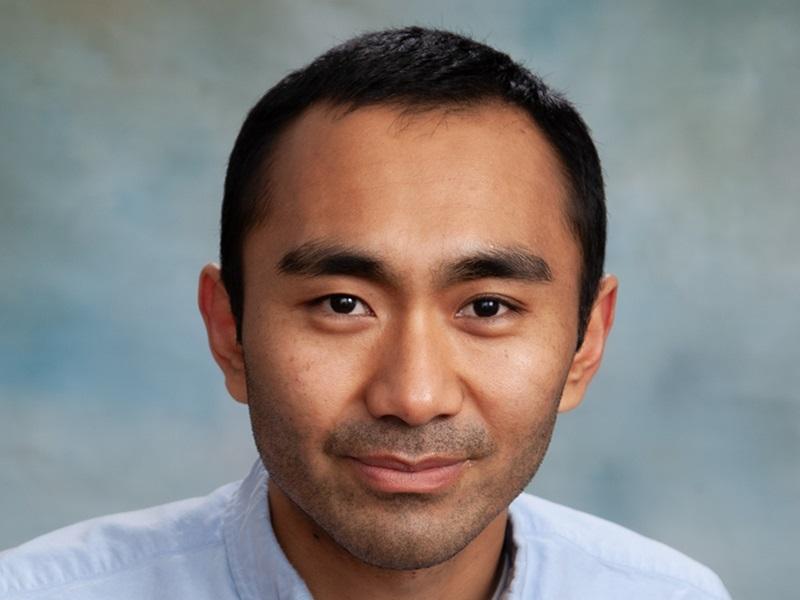

“Any type of uncertainty, despite the decrease in interest rates, just causes people to pause to make sure that there's a little bit more certainty as we roll through the market with respect to unemployment rates, trade and overall economic growth,” Altus Group vice-president of data solutions client delivery Ray Wong told RENX.

“It was also based on pricing and the bid-ask gap between buyers and sellers. We started seeing a little bit more deal flow - especially on the office side - happen in the second half of 2025.”

Investment activity was down last year in each of Vancouver, Edmonton, Calgary, Ottawa, Montreal, the Greater Toronto Area (GTA) and Greater Golden Horseshoe (GGH) region. The total number of transactions was also down, dipping below 2,000.

Retail and hotels were the only asset classes where the transaction dollar amounts were higher in 2025 than 2024 nationally.

Industrial led the way in GTA and GGH

Industrial had the highest 2025 transaction volume total of any sector in the GTA and GGH at $6.94 billion.

“Despite industrial availability rates moving up, industrial actually did a little bit better than expected in 2025 based on all the trade discussions,” Wong observed. “There's still demand for newer space to allow for better efficiency through automation.”

Transaction volume for the other major asset classes in the heavily populated Ontario regions were:

- retail at $3.62 billion;

- industrial, commercial and investment land at $3.31 billion;

- apartments at $3.1 billion;

- residential land at $2.43 billion;

- office at $1.55 billion;

- hotels at $694.1 million;

- and residential lots at $123.9 million.

Canadian private investors dominate acquisitions

Canadian private investors accounted for by far the highest share of GTA and GGH acquisition volume with $11.7 billion.

Users were responsible for $2.09 billion, developers for $1.73 billion, Canadian public investors for $1.19 billion, institutions for $1.14 billion, government for $681.7 million, foreign private investors for $480.1 million, builders for $177.5 million and foreign public investors for $91.2 million.

“I think we’re going to see a little bit more activity in 2026 compared to 2025,” Wong said. He also anticipates the second half of this year to be busier than the first.

“Core assets are going to move. There’s still uncertainty in the marketplace, but I think it will be an interesting year for transactions.”

GTA and GGH Top-10 CRE transactions

These were the 10 largest (dollar value) CRE transactions of 2025 in the GTA and GGH, according to Altus Group.

1. Primaris REIT (PMZ-UN-T) acquired the 793,000-square foot, more than 170-store Lime Ridge Mall, at 999 Upper Wentworth St. in Hamilton, from an entity managed by Cadillac Fairview for $416 million on June 17.

2. Primaris also acquired the 1.22-million-square-foot, 260-store Oshawa Centre, at 419 King St. W. in Oshawa, from Ivanhoe Cambridge for $375 million on Jan. 31.

3. Starlight Investments acquired a portfolio of four apartment buildings with a combined 1,116 units on Charolais Boulevard and McMurchy Avenue South in Brampton from Oxford Properties for $312.1 million on Dec. 19.

4. Veyron acquired a newly built 1.26-million square foot distribution centre on a 55-acre site at 3575 Innisfil Beach Rd. in Innisfil, north of Toronto, from DSV Solutions Inc. for $300.5 million on Sept. 29. DSV has entered into a long-term leaseback for the facility.

5. Crestpoint Real Estate Investments Ltd. and an unnamed institutional investor each acquired 50-per cent stakes in a 745,121-square-foot industrial building at 7900 Airport Rd. in Brampton from Unilever Canada Inc. for $253 million on March 27. The facility is fully leased to Unilever.

6. Pacific Reach and Dilawri Group of Companies acquired the 53-storey, approximately 700,000-square-foot, 263-room The Ritz-Carlton hotel at 181 Wellington St. W. in Toronto from Cadillac Fairview for $247.65 million on July 24.

7. Lankin Investments acquired three apartment buildings with a combined 755 units at 2, 4 and 6 Silver Maple Ct. in Brampton from GWL Realty Advisors for $247 million in two transactions in May and December.

8. Dream Industrial REIT (DIR-UN-T) and Singapore-based GIC acquired a portfolio of 11 industrial buildings totalling 996,552 square feet in Pickering, Oshawa, Ajax and Whitby from Pure Industrial for $243.04 million on Feb. 6.

9. Prime Storage acquired three self-storage buildings — at 200 Fairbank Ave. in Toronto, 3020 Lenworth Dr. in Mississauga and 20 Pugsley Ct. in Ajax — totalling 523,000 square feet from Vaultra Storage and Peerage Capital for $152.5 million on Aug. 5.

10. LaSalle Investment Management acquired Litho, a 210-unit apartment building at 740 Dupont St. in Toronto, from RioCan REIT (REI-UN-T) and Woodbourne for $152.4 million on Sept. 29.