Four major transactions in less than two months. Over 1,800 apartments. In excess of $572 million changing hands. Montreal's apartment building transaction market has suddenly kicked into overdrive.

And there is likely more to come, with several other large portfolios on the block.

In an uncertain economy, investors are looking for acquisitions that are more defensive in nature and “multifamily has always been considered a defensive asset,” according to Mark Sinnett, principal, executive vice-president and of head capital markets, Quebec at brokerage Avison Young, which has handled several of the recent transactions.

Among the most notable trades:

- The $128-million acquisition earlier this month by Federal Real Estate of three 16-storey towers with 440 units on Macdonald Ave. in Côte Saint Luc.

- The $97-million acquisition by KIN Income Fund, along with Vered Group of the 10-building, 412-apartment Domaine Choisy in the east-end borough of Saint-Léonard from Greyspring Apartments. The portfolio was acquired by Greyspring in 2021 for an unknown amount, and was previously sold by CAPREIT in 2016 for $31.4 million.

- The $249-million sale by the Saroukian Group to Boardwalk REIT of Phases 1, 2 and 3 of the 541-unit Central Parc Laval for $249 million, in what Sinnett says is the largest multifamily sale in Quebec in 2025.

- The $98.5-million sale by Hazelview Properties to Kejja Group in September of Port de Mer, a two-tower, 386-unit multifamily property in downtown Longueuil on Montreal’s South Shore, facing the Longueuil–Université-de-Sherbrooke métro station.

More portfolios are for sale

There seems to be more to come. CBRE has been retained to market Le Parc, a two-tower, 365-unit multifamily complex at 3450-3460 Drummond St. in downtown Montreal’s Golden Square Mile.

Built in 1971, the two 19-storey buildings have had $30 million in capital expenditures since 2014 and 18 per cent of units have been renovated. Other upgrades include enhancements to common areas, HVAC systems, elevators, windows, balcony doors and concrete foundation slabs.

The buildings are 91 per cent occupied. In-place rents are below market with an average historical turnover rate of about 20 per cent.

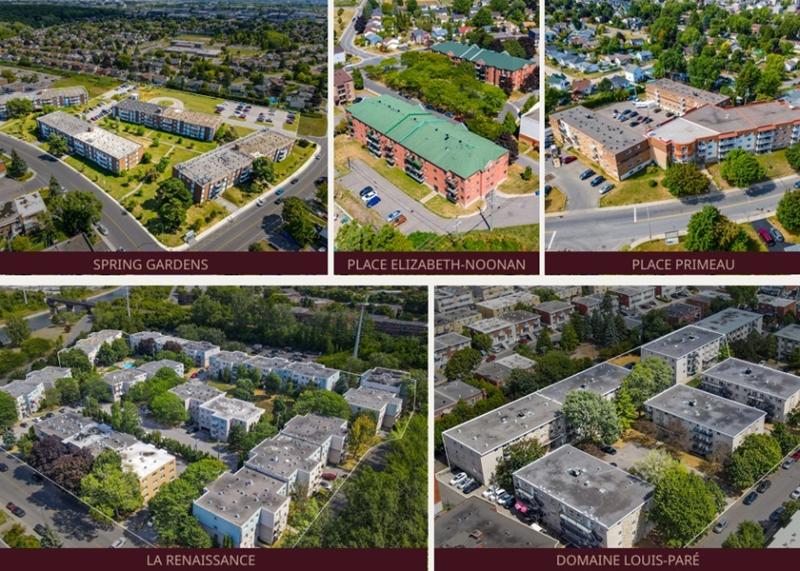

In addition, Avison Young is handling the sale by a private consortium of the West End Portfolio, an 828-unit portfolio of five apartment buildings in Lachine and LaSalle, Dollard des Ormeaux on the West Island and Châteauguay on the South Shore.

“We’re seeing quite a bit of activity on that one,” Sinnett says of the portfolio, one of the largest multifamily offerings in the Montreal area this year. It comprises:

- the 220-unit Spring Garden Complex in Dollard;

- the 260-unit La Renaissance in LaSalle;

- 144-unit Domaine Louis-Paré in Lachine;

- the 106-suite Place Primeau and the 98-unit Mary-Elizabeth-Noolan Complex, both in Châteauguay.

With an overall occupancy of 80 per cent and average rents of $951, well below market values, the portfolio represents a substantial opportunity for investors to capture unrealized growth through tenant turnover and value creation for vacant units, Avison Young says.

Multifamily "sought-after asset class"

Sinnett says multifamily “remains a sought-after asset class,” but during the past two quarters investor sentiment has changed.

Over the past few years, investors sought value-added transactions in which they could raise rents; they're now seeking multi-family because of its defensive nature.

He notes investors are increasingly seeking assets that are stable and have cash-flow. Assets like Macdonald, Central Park and Port de Mer (all handled by Avison Young) are leased at 98 per cent or higher and have strong cash flows.

The Macdonald portfolio at 5150, 5350 and 5500 Macdonald Ave. (near Queen Mary Road) had the same family ownership since it was built in 1974.

“The vendor’s goal was to find a purchaser that could continue to maintain and operate the buildings in the way that they currently were being operated, which I would say is a first-class property,” Sinnett said.

The buildings were constructed as high-end, luxury assets and have maintained that standard in their 51 years of operation. Amenities from a squash court to 24-hour doorman have been retained: “We don’t see that very often anymore.”

The apartments, which average 1,054 square feet, have historically had a 99 per cent occupancy rate. As there are several long-term tenants, rents are below market levels. However, the portfolio offers a combination of stable income and long-term growth potential.

There were 12 offers for the portfolio. “We found a perfect buyer,” says Sinnett, noting local Montreal buyer Domenic Pappadia, the president of Federal Real Estate, grew up across the street and once delivered newspapers to the buildings.

Central Park sale involves modern portfolio

The Central Park Laval sale represents “a great example of an institutional investor identifying a best-in-class, modern, latest generation, multifamily asset,” Sinnett says.

Located adjacent to the Carrefour Laval mall, the purpose-built rental development was constructed between 2019 and 2023. The property offers amenities such as a rooftop infinity pool, sky lounge, cinema room, fitness facility, putting greens, and a one-acre private park.

Avison Young says the transaction underscores the growing trend of institutional investors infusing capital into new purpose-built rental developments.

Central Park also includes a shovel-ready development site for two additional towers with 419 units and future expansion land for another. It is to total 1,100 units when completed.

While the asset offers many positives, Sinnett cautions there are a few headwinds in multifamily. Recent federal government policies to reduce temporary foreign workers are “starting to see an impact” in terms of slightly higher vacancy rates in gateway cities like Toronto and Montreal.

Still, he believes interest in multifamily will continue even with slightly higher vacancies, given the stability the asset class offers.