More major banks and large companies are mandating that employees be in the office at least four days each week, with many smaller firms expected to follow suit. This is leading to increased optimism among office building owners and managers.

According to Colliers Canada’s Q2 2025 National Market Snapshot report, there has been 749,043 square feet of new downtown office space and 397,737 square feet of new suburban office space delivered through the first half of the year in 12 major markets across Canada.

There’s 2.21 million square feet of downtown office space and 1.82 million square feet of suburban office space under construction in those same markets.

“It's coming down to a much more manageable level,” Colliers Canada head of research Adam Jacobs told RENX.

“It's still a decent-sized number, but compared to where we were four or five years ago, it's way down. I don't see it having a huge impact on the market.”

Strong demand for trophy office buildings

The Colliers report shows the national downtown office vacancy rate is 16.3 per cent while the suburban office vacancy rate is 12.8 per cent.

However, the gap in demand for trophy office space and lesser quality space is widening. The AAA office vacancy rate is now only three per cent in downtown Toronto and 4.9 per cent in downtown Vancouver.

This has led some to speculate that pre-leasing efforts for another trophy office tower in downtown Toronto could start within 18 months.

“If you really want AAA right now, you wouldn't have much available,” said Jacobs.

“It only takes one tenant to say, ‘Okay, I'll pre-lease 10 or 20 floors or something like that.’ And then then you can start to go ahead and have a lender and make that project viable.”

An obstacle that could prevent that from happening, however, is that lenders still lack confidence in office development. Many would want to see more of a recovery in the asset class before they start to put more money behind it.

Office leasing should improve

The demand for AAA space could also provide some relief for older and less amenitized office assets, as return-to-office mandates have companies seeking more space for their employees. If it’s not available in trophy buildings, good class-A or even upgraded class-B buildings could get a boost.

“The leasing outlook for those places has been pretty tough,” Jacobs said, “but I think the next 12 months could actually be pretty positive, in terms of the demand for space downtown still going up and the development cycle kind of dying off.

“Some people aren't going to be willing to wait. The thing about pre-leasing is that you have to wait five years. Maybe there will be another tower, but you know that it won't get finished until 2030.

“But in the meantime, you still need space. In the next six months there's going to need to be some leasing that happens outside of just the trophy assets.”

While office vacancy rates have steadily risen and remained elevated since the onset of the COVID-19 pandemic, Jacobs thinks an inflection point will soon be reached and they’ll start coming down.

“The population has grown a lot and companies are bigger and they may need more space than they did six or seven years ago,” Jacobs said. “There's more pressure on leasing, there's positive absorption and I think that everyone's waited a long time for that turnaround to happen.”

Office rents and building transactions

The average asking net rent for downtown space in the 12 cities covered in the Colliers report is $24.09 per square foot, while it’s $19.05 in the suburbs.

Landlords have been offering free rents and improvements to spaces as part of lease negotiations since the downturn in the office market, which have kept rental rates from declining as much as some might have expected. Jacobs expects conditions to become more favourable to building owners and for net effective rents to increase in the long term.

Downtown office building transactions remain slow and many prominent towers are owned by large institutions with long investment horizons that don’t need to sell in a down market. But Jacobs said some owner-occupiers have been taking advantage of investors being on the sidelines and purchased smaller buildings for their own use.

“With suburban office, the pricing is pretty good,” Jacobs said.

“Part of it is that redevelopment potential that everybody wants because the city's growing and there's going to be transit expansion. You can project forward with some of that stuff.”

Office use should start climbing

Weekly office use has stabilized at around 60 per cent, but that number should climb as employers demand a larger presence. Jacobs doesn’t believe 100 per cent is a realistic number but isn’t sure where the usage rate will max out.

Jacobs also pointed out there could be 100 per cent office attendance on a Wednesday morning, but a much lower number on a Friday afternoon, both of which contribute to the weekly average. And three or four in-office days carry the same space requirements as five. When employees are in the office, they need space to work.

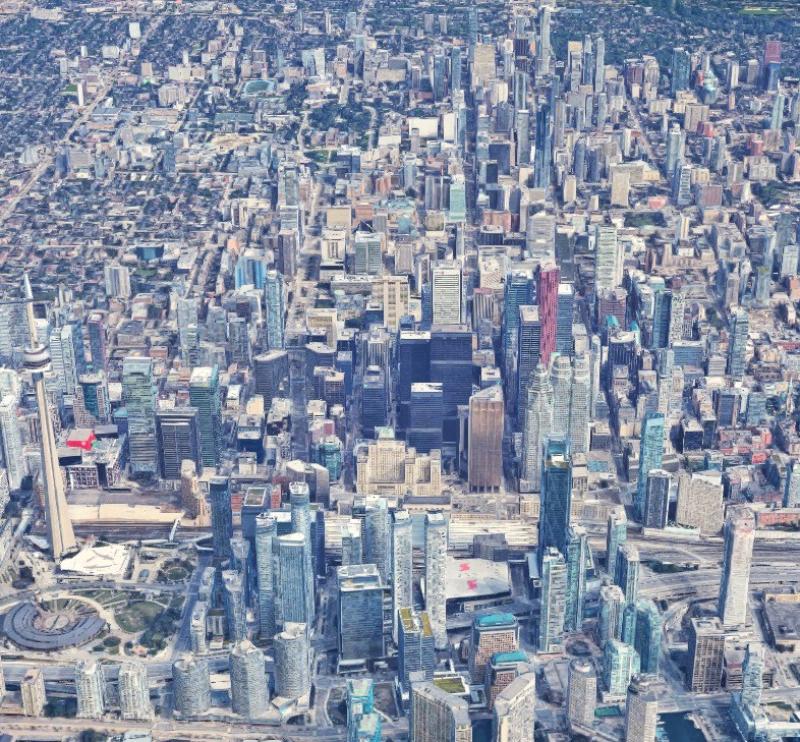

Downtown Toronto has been slower than other markets in getting workers back to the office, according to Jacobs, due to such factors as long commuting times, a lack of parking and inefficient public transit.

“I think people would concede that the downtown situation is just a bit worse than it used to be, and the outlook for that improving is more of a multi-year thing, instead of it's going to be resolved in the next three months.”

Jacobs believes governments and large financial and insurance companies are better set up for hybrid work than smaller firms because of the infrastructure they have in place. Those that have been more aggressive in mandating a return to the office generally hadn't occupied as much space as the larger organizations, he noted.